Better Educational Financing Options - Grupo Milenio

En México, la matrícula universitaria anual ha rondado los 4.5 million students in the last five years, just 40% of the demand, since that is the capacity to capture the public higher education system in the country, according to data from the

Organization for Economic Cooperation and Development (OECD).

In this sense, although public institutions extend their places year after year, with the goal of capturing 45% of the demand by 2025 - and thus reaching the average of the OECD countries - the demand will always be greater and therefore it isnecessary to find viable options to access education in private institutions.

Mucho de este acceso depende de una buena planeación y manejo de las finanzas familiares. Existen muchos caminos para llegar a Roma.Educational insurance, a scholarship or student credit are the alternatives to consider, and the convenience of each one is linked to the family situation.

Nonantzin Martínez and the father of his son did not want to risk and, since the child had a month of birth, they decided to acquire educational insurance.Thanks to this financial forecast, the fate of the 8 -year -old will be different from the 221,520 young people who for 2020 did not conclude their university, according to figures from the National Institute of Statistics and Geography (INEGI), published last March in theirSurvey for the measurement of the impact COVID-19 on education (Ecovid-Ed) 2020.

Among other remarkable data of the survey, 8% said they left their studies due to lack of money or economic resources and 17% who had to work to support his family during the emergency.For the 2020-2021 school year, the figures were not encouraging.INEGI pointed out that 1.4 million young people (between 19 and 24 years old) did not sign up for higher education due to lack of resources and 973,000 young people (between 25 and 29 years old) postponed their postgraduate studies for the same reason.

Annually, Nonantzin and their partner pay about 60,000 premium pesos for the insurance and when they turn 18 your child will receive just over one million pesos.He will decide if he wants to use it to study or undertake, because the funds - although basic they have an educational purpose - do not condition their use.Eloy López, financial forecast director, explains that within the field of life, educational insurance is the most requested third parties in Mexico.

The market offer is wide, the main insurers, such as GNP, Mapfre, Allianz, Metlife and Monterrey - which is the one that hired Nonatzin - they have a product of this type."The objective of these instruments is to ensure that the son studies, alive or dies the dad or mother," said López.In this financial product, premiums depend on the amount you want to save.

"Hire something you can pay the same today as in the long term.The ideal for hiring this insurance is to do it when your child is under 3 years and in a period of limited payments between 5 and 10 years, ”recommends López.

Take advantage of your potential

Carlos Esparza is the second of four brothers.He studied the Bachelor of Communication and Digital Media at the Tecnológico de Monterrey, Campus Querétaro, with an excellence scholarship of 90%.His parents and he paid a little more than 5,000 pesos of tuition for four and a half years.To conserve the scholarship, Carlos's commitment was to maintain an average above 9, and subsequently take diplomas, extracurricular, cultural and sports classes, to enrich his formation."The scholarship was an economic relief for my family.While my dad had a good job, the expenses with four children were very strong, so my older brother and I seek to enter private universities with scholarship.That allowed me, in the medium term, to go student exchange to a university of the most prestigious in Australia for six months, ”says the 28 -year -old.

oh boy i can't wait to learn how to make ishgardian rock salt!! https://t.CO/PDJWyl1ZZB

— Piku, CEO of Liking Girls @ ARTFIGHT (Comms OPEN) Sat Jul 10 00:03:07 +0000 2021

Today Carlos studies the Master in Digital Humanities in his Alma Mater, with a 45% scholarship.To grant scholarships, universities look for young people who have had an outstanding average in high school and high school, or a prominent profile in the performance of some cultural, scientific or sports activity.

“Hence the importance of the student preparing an attractive curriculum during the three years before entering the university, in which he mentions if it is good in a sport, touching an instrument, if he belongs to a civil organization that does social workor its academic performance is high, ”suggests Ivonne Vargas, a member attached to the Center for Formal Employment Studies and author of the book Contrastame!The Tec de Monterrey and the Iberoaméricana University offer scholarships up to 100% for the vulnerable population.

For its part, the University of the Valley of Mexico contemplates cultural and sports scholarships, to mention some examples.

For more than 15 years, Santander Universities is another option that strengthens higher education.In Mexico it has granted more than 110,000 scholarships of different types;This year they already placed 25,000 digital scholarships thoroughly lost through 25 calls.

"We have focused on scholarships that help the employability of young people, who give them both soft and technical skills to be able to integrate into the labor market, and this responds directly to the contingency in which we are," explains Solomon Amkie, director of RelationshipsInstitutional of Santander Universities and Universia Mexico.

Committed to your future

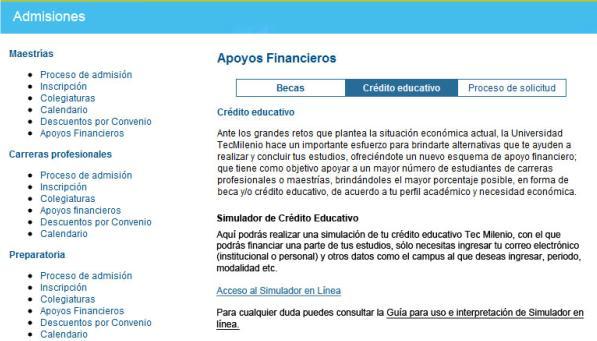

If your child and you have decided that he will study at a private university, Ivonne Vargas recommends that, at least one year before entering the race, you review the cost of the program and the financing options that exist.In addition to each university, there are other institutions that can give you a loan for educational purposes, such as multiple financial societies (Sofomes) Finae and its Ennti program;Educational Financial of Mexico (Finem), and Laudex.In case your child wants to pursue a master's degree abroad, review the options offeredand 90% credit).

This Foundation seeks that the following student be financed with the repayment.His scheme provides 6 months of grace, before the student begins to pay the loan, for which he has a total period of 5 years.

“Ideally, those Mexicans who are going to study abroad return and lead the country's companies.We are interested in learning from the big.

These types of institutions request a solidarity endorse.Ivonne Vargas ensures- based on sophome figures mentioned above- that in Mexico the use of credit for units are underutilized, as it barely reaches between 1 and 2% of the market volume that Mexico has.

In other economies, such as that of the United States and Europe, the penetration percentage becomes up to 50%.Now that you know the options that exist to study your degree or a postgraduate.

In case of needing a loan, investigate the deadline, the interest rate, the total annual cost, the commissions, if payments can be admitted, if there is a period of grace and what is the payment scheme.

Noticias relacionadas