Santander launches its land macro -manager with 13,000 assets and new brand

Santander has concluded the tuning of his soil macro -manager that he devised last year and launches commercially with a new brand.Although the company, which has the largest land portfolio for sale in the country, was born with the name of Landmark, has started its renamed activity like Landco.He has also opened various delegations in the country, in addition to starting to look for alliances with promoters.He has also signed new counselors, among which Antonio Hernández Mancha, former president of Alianza Popular stands out.

The company was born in 2019 under a novel model in Spain, that of the manager only of soils, with the aim of urbanistically managing the land from the bank's adjudicated.In this way, it manages to convert soils into finalists, which gives them more value and thus be able to sell them to companies such as promoters or funds.This urban development process is complex and can take years of work.

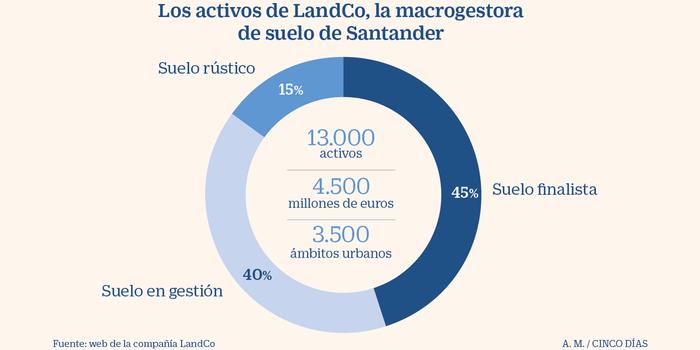

The financial entity chaired by Ana Botín has crossed this company 13.000 assets from the bank, a way to drain from its balance the real estate exposure.The gross value of Landco's land portfolio reaches 4.500 million euros and are located at 3.500 different urban areas.These plots have 45% the finalist land rating, 40% of management in management and 15% as rustic.

Landco has opened territorial delegations in Madrid, Cataluña, Valencia, Malaga, Sevilla, Bilbao and for the Peninsular Northwest Zone, according to Banco Fuentes.In its commercial premiere, despite the crisis generated by the Covid-19 Pandemia, the company has already sold plots for a value of 60 million.

Appointments

The company controlled by Santander now incorporates the Council as Independiente to Hernández Mancha, a state lawyer who has its own legal firm and is also currently advisor to Enagás.This veteran lawyer, who will turn 70 in 2021, was well known for being at the end of the eighties leader of the popular opposition to Felipe González's socialist government.

I usually Just Clear My Mind By Listening To Music Makes Me Drift Away For A Bit Even Just Simple Meditation It ’… https: // t.CO/2IA64ABAUC

— liga Fri Dec 27 23:49:59 +0000 2019

Likewise, Landco incorporates Enrique Gracia as Independent, with experience in real estate sector such as Metrovacesa, Gecina, Marline or Aedas.As president of the Company, in recent months, Peio Arechebaleta has been incorporated, who was president of the Banesto Corporation.

In the Council also remains Javier García-Carranza, Deputy Director of Santander and commissioned by President Ana Botín to pilot the bank's real estate strategy.They also do two managers of the financial entity linked to the brick business: Carlos Manzano and Juan Babio, as stated in the Mercantile Registry.

The real estate company has Alberto burned as CEO, who came from the Board of Directors of the Residential Promotora Habitat (from the Bain Capital Fund), and who previously held management positions in Quabit and Ferrovial.

Looking for partners

During the company's first life exercise, the main focus of its managers has been in the creation of the work team and the exhaustive analysis of assets.The strategy of the company is the gradual sale of the portfolio, but it is also able to explore forms of collaboration with promoter companies, both the large nationals and other premises, to participate in urban developments and facilitate access to finalist soilsIn the sectors where they can have interest.Landco is also preparing to manage in the future assets of other companies possessing land.

The soil portfolio comes from the Santander balance, but it will also incorporate and manage all the soils that the bank is awarded in the future.

Otras posiciones del banco en inmobiliario

Quasar.The great real estate operation of Santander was the transfer in 2018 of the Popular brick to Blackstone, the one known as the Quasar Project, where the bank has 49% of an asset portfolio managed by Aliseda.In this way it detached properties with a gross value of 30.000 million euros.It also detached from the majority of the capital of its Servicer Altamira, initially acquired by Apollo, which resorted to Dobank.

Marline.Santander has starring different operations to reduce its brick exposure.A clear example has been that of the historic Metrovacesa. Después de sanear la inmobiliaria tras la crisis, la entidad (junto a BBVA) desgajó los activos terciarios de la inmobiliaria y los integró en la socimi Marline a cambio de una participación del 22,3%. A su vez, de las viviendas que Metrovacesa tenía en alquiler, creó junto a Marline la socimi Testa Residencial, cuya participación vendió a Blackstone.

Metrovacesa.In the capital of Metrovacesa, which led with BBVA in 2018, it is present with 49.3% of the shares after providing soils in non -monetary capital extensions.